The concept of generating income through online platforms has evolved significantly over the past decade, driven by advancements in technology and the increasing accessibility of digital tools. While the name "FootFinder" may not be widely recognized in global financial circles, it presents an intriguing opportunity to explore how niche platforms can be leveraged for financial growth. At its core, FootFinder likely operates as a service or application designed to connect individuals with specific market demands, possibly in sectors such as e-commerce analytics, market research, or data-driven business solutions. To understand how such a platform might be utilized effectively, it's essential to dissect the underlying principles of online monetization, evaluate the potential risks and rewards, and outline a strategic framework for maximizing returns while minimizing exposure to financial pitfalls.

One of the most critical aspects of any investment strategy is comprehending the platform's value proposition. If FootFinder functions as a tool for analyzing foot traffic data or consumer behavior in retail spaces, it could serve as a bridge between data science and business decision-making. Users might generate revenue by providing insights to merchants, identifying high-traffic zones, or optimizing store layouts. Alternatively, it could operate as a crowdsourcing platform where participants offer expertise in exchange for compensation, such as analyzing market trends or developing targeted marketing strategies. The key differentiator here is the platform's ability to transform raw data into actionable intelligence, enabling users to monetize their analytical skills or industry knowledge. However, it's crucial to assess whether the platform's data sources are reliable, its algorithms are transparent, and its monetization model is sustainable. In any case, the foundation of success lies in a deep understanding of the platform's mechanics and the ability to identify opportunities that align with one's strengths and market needs.

For individuals looking to capitalize on FootFinder's offerings, a structured approach is necessary. Begin by evaluating the platform's niche and assessing whether it addresses a specific pain point in the market. If it's focused on consumer behavior analysis, consider how your expertise in data science or marketing can be applied. If it's a community-driven model, explore ways to build credibility through consistent contributions or specialized knowledge. It's important to recognize that online monetization often requires a combination of technical proficiency, strategic insight, and adaptability. For instance, if FootFinder connects users with small businesses needing data analytics, one might start by offering free consultations to build a portfolio of successful projects, then transition to paid services as demand grows. This approach not only establishes trust but also allows for scalable revenue generation. Additionally, staying informed about industry trends—such as the rising importance of digital footprints in retail or the evolving demands of remote workforce management—can help users anticipate opportunities and align their efforts with market needs.

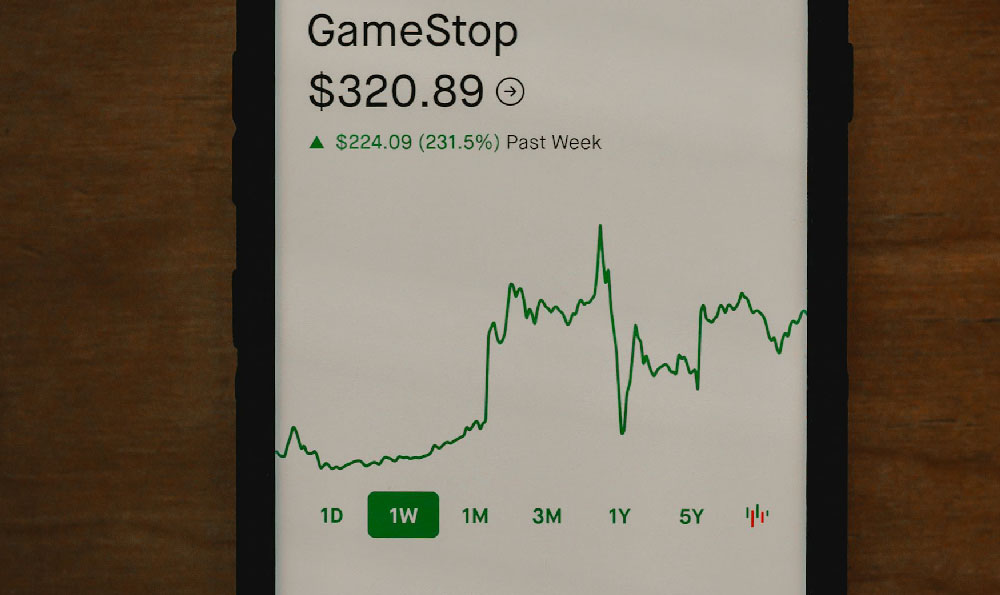

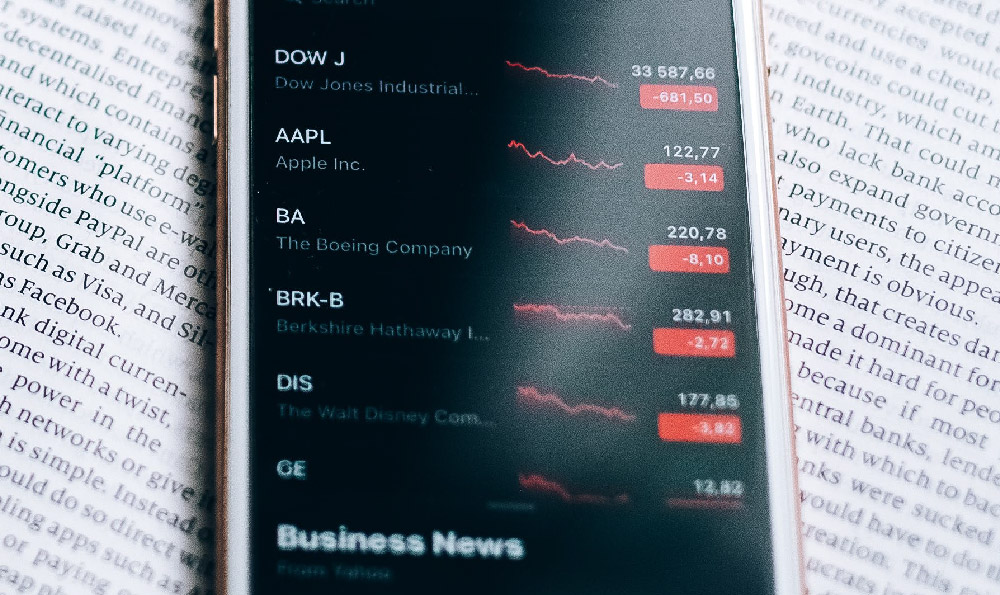

However, the path to financial success through FootFinder, or any online platform, is not without challenges. One of the primary risks is the potential for overcommitment with limited returns. Many platforms rely on a freemium model, where initial engagement is free but monetization tiers require significant time or effort investment. Users must carefully analyze whether the platform's earning potential justifies the time spent, especially when balancing other responsibilities. Another critical consideration is the volatility of online markets. Algorithms can change, user engagement fluctuate, and demand for specific services may shift rapidly, making it essential to diversify income streams rather than relying solely on a single platform. For example, while FootFinder might provide short-term consulting opportunities, pairing it with passive income methods like affiliate marketing or content creation could create a more resilient financial strategy.

The role of continuous learning cannot be overstated in optimizing returns. Whether it's mastering data visualization tools, understanding consumer psychology, or refining business strategy frameworks, acquiring specialized knowledge enhances the value proposition. Users should also be wary of burnout, as online monetization often demands high levels of self-discipline and creativity. Establishing a weekly schedule that balances active engagement with rest periods ensures long-term productivity. Moreover, financial planning should be integrated into the strategy, with a focus on reinvesting earnings into additional skills or tools that amplify potential returns. For instance, allocating a portion of profits to subscription-based software or online courses could improve analytical capabilities, making users more competitive in their niche.

To mitigate risks and maximize ROI, a multi-faceted approach is recommended. Start by validating the platform's credibility through reviews, case studies, or testimonials. Engage in a trial phase by offering low-stakes services to gauge market response, then scale operations based on demand. Building a network within the platform's ecosystem—whether through collaborations, mentorship, or knowledge sharing—can also unlock new opportunities and reduce isolation in a competitive space. Finally, maintaining a long-term perspective is vital, as online monetization often requires patience and persistence. The key is to treat FootFinder not as a quick-profit scheme but as a tool for gradual wealth accumulation, aligning efforts with personal goals and financial objectives. By combining strategic engagement, active learning, and risk management, users can transform their online participation into a viable financial endeavor.