Investing in oil and gas royalties can be a fascinating avenue for potential income, offering exposure to the energy sector without the direct operational complexities of drilling or exploration. However, like any investment vehicle, it's crucial to approach it with a clear understanding of its mechanics, risks, and suitability for your individual financial goals.

Before diving into the “how,” let's address the fundamental question: is investing in oil and gas royalties right for you? This depends heavily on your risk tolerance, investment timeline, and overall portfolio diversification strategy. Royalties represent a claim on a percentage of the revenue generated from the production of oil and gas on specific properties. This revenue stream can be quite attractive, particularly during periods of high energy prices, but it’s inherently linked to the volatile nature of the commodities market. If you're seeking a consistently stable and predictable income stream, royalties might not be the ideal fit, as production rates can decline over time, and prices can fluctuate dramatically due to geopolitical events, supply chain disruptions, or shifts in energy demand.

Conversely, if you have a higher risk tolerance and are comfortable with the cyclical nature of the energy industry, royalties can offer significant upside potential. The income generated from royalties can be substantial, especially from well-producing properties in prolific basins. Furthermore, owning royalties is a relatively passive investment compared to actively managing oil and gas operations. You’re essentially participating in the success of the energy extraction without directly bearing the operational responsibilities and liabilities. The key is to meticulously assess the potential risks and rewards associated with specific royalty interests.

Now, let's explore how to actually invest in oil and gas royalties. There are several avenues available to potential investors, each with its own advantages and disadvantages.

One option is to purchase royalties directly from landowners or mineral rights owners. This can be a more direct and potentially lucrative approach, but it also requires significant due diligence. You'll need to thoroughly research the production history of the property, the estimated remaining reserves, the operator's track record, and the lease terms to ensure you're getting a fair price and a reliable income stream. This process often involves engaging with petroleum engineers, geologists, and legal professionals to properly evaluate the asset. This avenue demands a considerable amount of expertise and can be time-consuming, making it better suited for experienced investors with a solid understanding of the oil and gas industry.

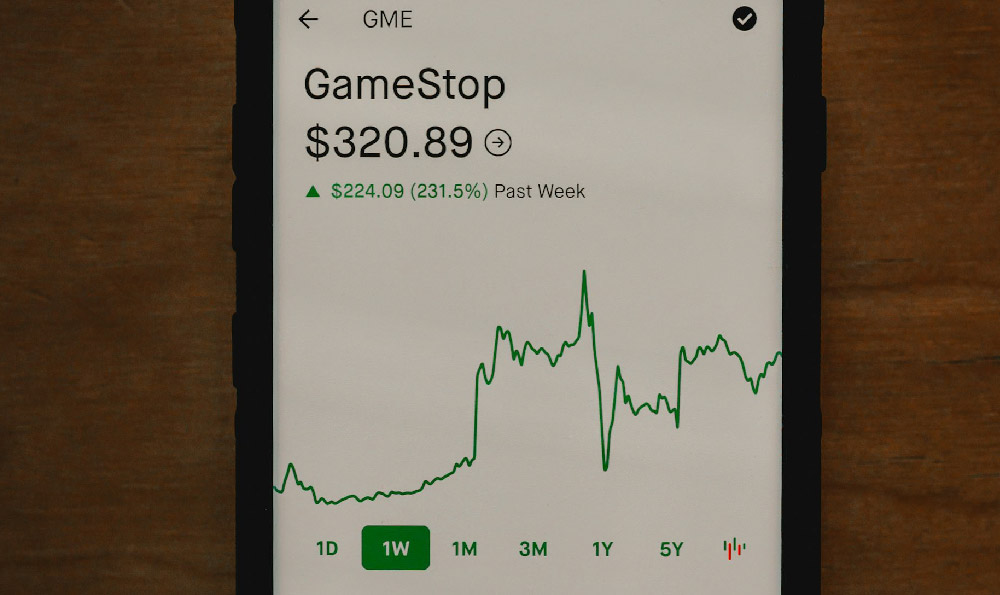

Another alternative is to invest in royalty trusts or mineral rights companies that own a portfolio of royalty interests. These entities typically trade on stock exchanges and offer investors a more liquid and diversified way to gain exposure to the oil and gas royalty market. While this approach provides easier access and greater diversification, it also comes with its own set of considerations. You’ll need to carefully analyze the trust's or company's portfolio, its management team, its payout history, and its expense ratio. The diversification benefit reduces the risk associated with any single well or property, but it also means that your returns are diluted across the entire portfolio.

Furthermore, be aware of the specific tax implications of royalty income. Royalty payments are generally taxed as ordinary income, and you may also be subject to depletion allowances, which can help offset some of the tax burden. It's important to consult with a tax advisor to understand the specific tax rules applicable to your situation and to optimize your tax planning.

Regardless of the investment method you choose, rigorous due diligence is paramount. Never invest in a royalty interest without first thoroughly investigating the underlying property and the operator. Scrutinize the production data, reserve estimates, and lease terms. Be wary of promises of unrealistic returns or overly optimistic projections. The oil and gas industry is inherently uncertain, and it's crucial to approach any investment with a healthy dose of skepticism. Understanding the geological characteristics of the area, the competency of the operator, and the prevailing market conditions are all critical components of a successful royalty investment strategy.

Moreover, consider the long-term outlook for the energy industry. The energy landscape is constantly evolving, with increasing emphasis on renewable energy sources and a growing awareness of environmental concerns. While oil and gas are likely to remain important energy sources for the foreseeable future, it's important to factor in the potential impact of these trends on the value of your royalty interests. Diversifying your investments across different energy sources and asset classes can help mitigate the risks associated with any single sector.

Finally, remember that investing in oil and gas royalties is a long-term game. Production rates can fluctuate, and prices can be volatile, so it's important to have a long-term perspective and to avoid making impulsive decisions based on short-term market fluctuations. Building a diversified portfolio and sticking to a disciplined investment strategy can help you navigate the ups and downs of the energy market and achieve your financial goals. Treat royalty investments as one component of a broader financial plan, not as a quick path to riches.

In conclusion, investing in oil and gas royalties can be a potentially rewarding opportunity, but it requires careful planning, thorough due diligence, and a clear understanding of the risks involved. By carefully evaluating your risk tolerance, researching the investment options available, and seeking professional advice, you can make informed decisions that align with your financial goals and help you build a successful portfolio. Always remember to prioritize risk management and to never invest more than you can afford to lose.