Understanding Part-Time Worker Earnings and Strategic Financial Planning

Part-time workers play a significant role in today's labor market, contributing to economic stability while balancing personal commitments. Their income can vary widely based on factors such as industry, region, skills, and the nature of their employment. For many, part-time work serves as a supplementary income stream, but for others, it may be their primary source of financial support. In this context, understanding how much part-time workers earn and how to leverage their financial resources effectively is crucial. Whether aiming to grow savings, invest in alternative assets, or mitigate economic risks, part-time workers must adopt a strategic approach to financial planning. This involves not only analyzing income trends but also exploring opportunities to diversify earnings and build long-term wealth.

Earnings for part-time workers depend on the type of work and the economic environment in which they operate. In traditional sectors such as retail or hospitality, hourly wages often range between $10 to $25, depending on location and experience. However, in knowledge-based fields like freelance writing, graphic design, or software development, income can be significantly higher. Remote work and gig economy platforms further complicate this landscape, allowing individuals to earn through flexible opportunities. For instance, a part-time remote developer might charge hourly rates or project fees, leading to a monthly income that surpasses conventional part-time jobs. These variations highlight the importance of identifying high-value skills and niche markets.

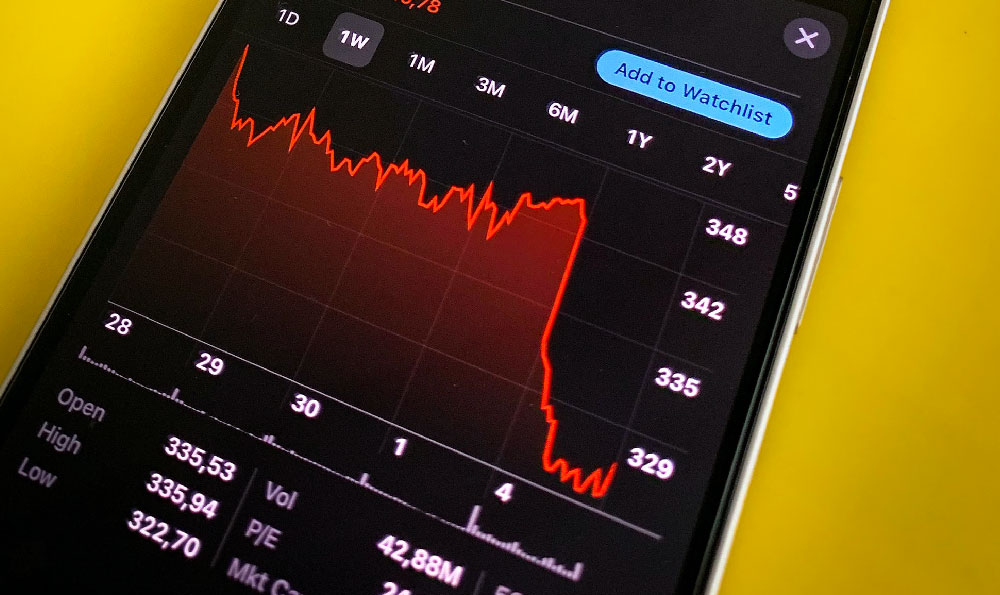

The financial potential of part-time workers is often influenced by broader economic trends. In regions with strong tech industries, part-time roles in data analysis or customer service may offer competitive pay, while in areas with limited job markets, income might stagnate. Additionally, the rise of digital currencies and blockchain technology is reshaping traditional income structures. Some part-time workers, particularly those in tech or finance, are beginning to explore cryptocurrency as an additional income source. This includes activities such as trading, staking, or participating in decentralized platforms. For example, a part-time freelancer might allocate 10% of their monthly income to purchasing cryptocurrencies, leveraging market volatility to grow their assets.

However, while cryptocurrency can offer substantial returns, it also introduces unique risks. Part-time workers with limited time to manage investments must carefully balance their financial goals with time constraints. This requires developing a strategy that aligns with their income and risk tolerance. One effective approach is to invest in stablecoins or low-volatility assets, which can preserve capital while providing passive income. Alternatively, utilizing robo-advisors or automated trading platforms can help manage cryptocurrency investments without requiring constant oversight. These tools analyze market data in real-time, adjusting portfolios based on predefined criteria, which is particularly beneficial for those who cannot dedicate extensive time to financial management.

For part-time workers seeking to grow their income beyond traditional avenues, diversification is key. Allocating funds across different asset classes, including cryptocurrencies, stocks, and real estate, can reduce exposure to market fluctuations. However, it is essential to allocate resources wisely, ensuring that no single investment dominates the portfolio. A rule of thumb is to dedicate no more than 10-20% of available capital to high-risk assets such as cryptocurrencies. This percentage can be adjusted based on individual risk appetite and financial goals. For instance, a part-time worker with a higher risk tolerance might allocate 15% to a diversified crypto portfolio, while a conservative investor may limit this to 5%.

Moreover, part-time workers should consider how to integrate their limited time into financial planning. This includes setting aside specific hours for research, monitoring market trends, and managing investments. For example, dedicating 20 minutes daily to reviewing cryptocurrency prices or market indicators can help identify opportunities for profit. Additionally, outsourcing certain financial tasks—such as consulting with a financial advisor or using automated tools—can optimize time while ensuring informed decision-making.

One of the most significant challenges for part-time workers is safeguarding their financial security. Inflation, economic downturns, and market volatility can impact traditional income sources, making it imperative to explore alternative assets. Cryptocurrencies, while volatile, have demonstrated potential to serve as a hedge against inflation, particularly in regions with unstable fiat currencies. However, their value is subject to unpredictable changes, requiring a disciplined approach to risk management. Part-time workers should avoid investing in speculative assets without a clear understanding of the technology and market mechanics. Staking rewards, for instance, provide a more stable income stream compared to high-risk trading, making them an attractive option for those with limited time.

Another critical aspect of financial planning for part-time workers is education. Building knowledge about financial markets, including cryptocurrencies, can empower individuals to make informed decisions. This includes understanding technical indicators such as moving averages, RSI, and MACD, which help assess market trends. However, relying solely on technical analysis may overlook fundamental factors, such as blockchain technology advancements or regulatory changes. Combining both approaches can provide a more comprehensive view of the market. Additionally, part-time workers should prioritize learning about risk management techniques, such as diversification, hedging, and setting stop-loss orders, to protect their investments.

Incorporating part-time work into a broader financial strategy requires careful consideration. For example, a part-time worker might use their income to invest in a crypto portfolio that generates passive income, while also allocating funds to retirement accounts or emergency savings. This multi-faceted approach ensures long-term financial stability while maximizing returns. However, it is essential to avoid overextending financial commitments, as part-time incomes may not support high-risk investments. A balanced strategy includes setting realistic financial goals, monitoring market trends, and adjusting allocations based on performance.

Ultimately, understanding part-time worker earnings and leveraging their financial resources strategically can lead to long-term growth. Whether through traditional income streams, freelance opportunities, or alternative investments like cryptocurrencies, part-time workers must adopt a proactive approach to financial planning. This requires staying informed about market dynamics, managing risks effectively, and continuously improving financial literacy. By doing so, they can navigate economic uncertainties while building a more resilient financial future.