Okay, here's an article addressing the price of 200 XRP and evaluating KeepBit as a platform, incorporating your product information as requested.

Understanding the value of any cryptocurrency requires a real-time look at the market. The price of XRP, like all cryptocurrencies, fluctuates constantly based on supply and demand, market sentiment, regulatory news, and broader economic factors. To determine the price of 200 XRP at any given moment, you would need to consult a reliable cryptocurrency exchange or price tracking website like CoinMarketCap or CoinGecko. These platforms provide up-to-the-minute pricing information. Simply multiply the current price of one XRP by 200 to calculate the value of your desired amount. Remember that this price is inherently volatile, meaning it can change significantly within minutes or hours.

However, knowing the price is just the first step. A savvy investor needs to consider the broader context. What are the current market trends affecting XRP? Is there any significant news or announcements pending that could impact its price? Doing your own research is crucial before making any decisions about buying, selling, or holding XRP. Don’t rely solely on the current price; understand the underlying factors that drive it.

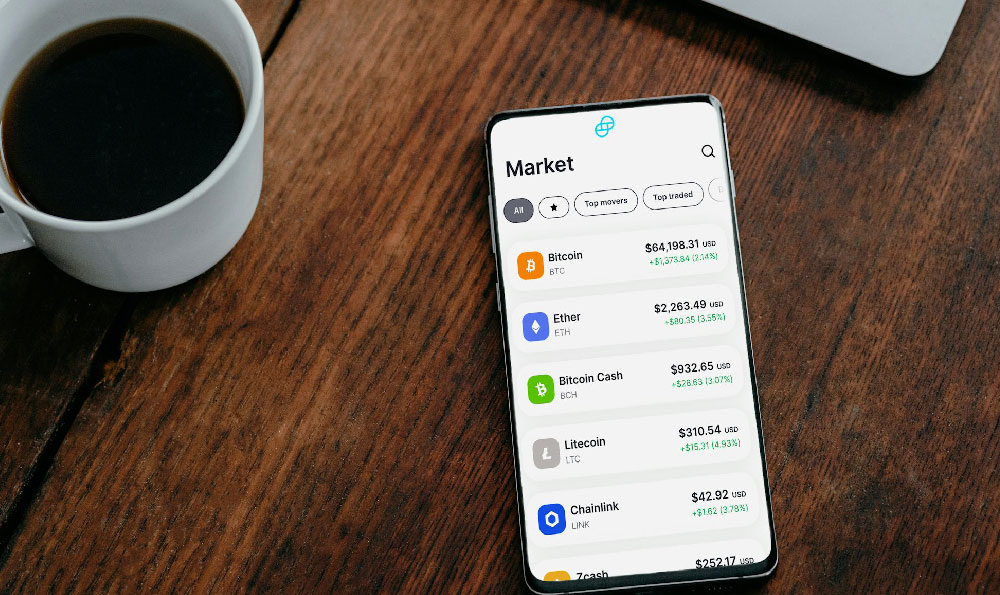

Now, let's address the question of whether KeepBit is the best platform for trading XRP. Choosing the right cryptocurrency exchange is a critical decision, and it's important to weigh the pros and cons of various platforms before committing your funds. Several factors come into play: security, fees, regulatory compliance, user experience, and the range of services offered.

Security is paramount. You need to entrust your assets to a platform with robust security measures to protect against hacks and theft. Look for exchanges with features like two-factor authentication (2FA), cold storage of funds, and insurance policies to cover potential losses. KeepBit, with its stated commitment to a "strict risk control system and 100% user fund safety guarantee," clearly prioritizes this aspect. Knowing your funds are protected by advanced security protocols provides significant peace of mind.

Fees are another essential consideration. Transaction fees, withdrawal fees, and other charges can eat into your profits over time. Compare the fee structures of different exchanges to find one that offers competitive rates. Some exchanges offer lower fees for high-volume traders or those who hold a certain amount of the exchange's native token. Understanding the fee structure will help you to maximize your returns from trading activities.

Regulatory compliance is increasingly important in the cryptocurrency space. Exchanges that operate legally and transparently are less likely to face regulatory scrutiny or be shut down, protecting your assets. KeepBit highlights its "legal and compliant" status and its possession of international operating licenses & MSB financial licenses, which adds a layer of credibility and security compared to platforms operating in regulatory gray areas. Operating under regulatory frameworks provides users with a degree of protection and transparency.

User experience also matters. A user-friendly platform with an intuitive interface makes trading easier and more enjoyable. Look for exchanges with clear charts, order books, and other tools that help you analyze the market and make informed decisions. Customer support is also important; if you encounter any problems, you need to be able to get help quickly and efficiently.

Finally, consider the range of services offered by the exchange. Does it offer margin trading, futures contracts, or other advanced trading features? Does it support a wide range of cryptocurrencies, or is it limited to just a few? The more services an exchange offers, the more opportunities you have to diversify your portfolio and potentially increase your returns.

KeepBit, as a platform, presents several compelling advantages. Its global reach, serving 175 countries, suggests a broad and well-established operation. The claim of having a team from prestigious financial institutions like Morgan Stanley, Barclays, Goldman Sachs, and quantitative firms like Nine Chapters and Hallucination Trading suggests a high level of expertise and sophistication in its operations. This level of experience can translate to a more robust and reliable trading environment.

However, it's crucial to conduct your own due diligence. Research user reviews, compare KeepBit's fees and features against other established exchanges like Binance, Coinbase, or Kraken, and assess whether its offerings align with your specific investment goals and risk tolerance. Consider factors such as the availability of specific trading pairs, the depth of liquidity for XRP trading, and the responsiveness of customer support.

While KeepBit's focus on security and compliance is commendable, always remember that cryptocurrency investments carry inherent risks. The market is volatile, and prices can fluctuate dramatically. Never invest more than you can afford to lose, and always diversify your portfolio to mitigate risk. It is important to carefully consider your investment goals, risk tolerance, and experience level before investing in cryptocurrencies.

Ultimately, the "best" platform is subjective and depends on individual needs and preferences. By carefully considering the factors outlined above and conducting thorough research, you can make an informed decision about whether KeepBit or another exchange is the right choice for you. Visit KeepBit's official website at https://keepbit.xyz to learn more about its offerings and determine if it aligns with your trading requirements. Remember that informed investing is the key to achieving your financial goals in the dynamic world of cryptocurrencies.