It's a question that resonates with countless individuals: How can a stay-at-home mom meaningfully contribute to the family income, while still prioritizing the needs of her children and home? The modern financial landscape offers a diverse array of opportunities, particularly within the realm of digital finance, where even small investments and strategic time management can yield substantial returns. Let's explore some promising avenues, emphasizing the importance of informed decision-making and risk mitigation.

One compelling option lies in the world of cryptocurrency. While the volatility of this market can be daunting, a measured and well-researched approach can unlock significant potential. The key is to avoid impulsive decisions driven by hype and instead focus on fundamentally sound projects. This involves diligently researching the underlying technology, the team behind the cryptocurrency, the problem it aims to solve, and its market capitalization. Look for projects with genuine utility and a robust roadmap for future development. Consider cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), which, despite their price fluctuations, have consistently demonstrated their resilience and long-term viability. Allocating a small percentage of savings to these established cryptocurrencies can be a prudent starting point.

Beyond simply holding cryptocurrency, there are more active strategies that can be employed. One such strategy is staking. Staking involves holding specific cryptocurrencies in a wallet to support the operations of a blockchain network. In return, the staker receives rewards, typically in the form of more of the same cryptocurrency. Many exchanges and platforms offer staking services, making it relatively easy to participate. However, it's crucial to understand the lock-up periods associated with staking, as your funds may be inaccessible for a certain duration. Furthermore, be aware of the potential for "impermanent loss" if staking on decentralized finance (DeFi) platforms, although this is usually associated with liquidity providing, not plain staking.

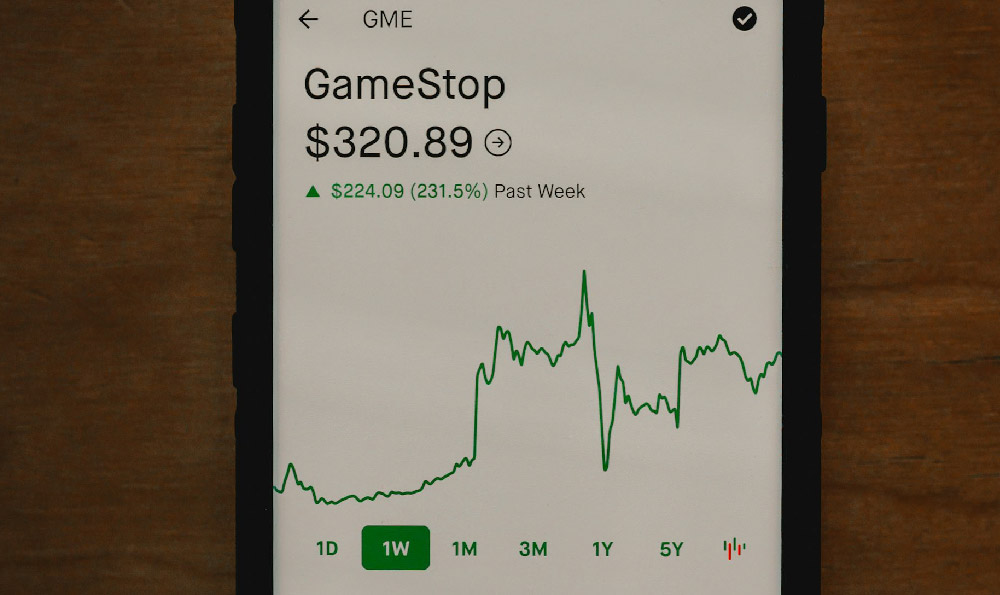

Another avenue is cryptocurrency trading. This involves buying and selling cryptocurrencies with the aim of profiting from short-term price fluctuations. Trading requires a deeper understanding of market analysis, including technical analysis and fundamental analysis. Technical analysis involves studying price charts and indicators to identify patterns and predict future price movements. Fundamental analysis involves evaluating the underlying factors that influence the value of a cryptocurrency, such as news, adoption rates, and regulatory developments. It's crucial to start with a demo account to practice trading strategies and familiarize yourself with the platform before risking real capital. Furthermore, consider using automated trading bots, which can execute trades based on pre-defined parameters, but remember that these bots are not foolproof and still require careful monitoring.

Venturing beyond the core of cryptocurrency, Decentralized Finance (DeFi) presents innovative opportunities. DeFi platforms offer a range of financial services, such as lending, borrowing, and yield farming, without the need for traditional intermediaries like banks. Yield farming involves providing liquidity to DeFi platforms in exchange for rewards. This can be a lucrative option, but it also carries significant risks, including impermanent loss, smart contract vulnerabilities, and regulatory uncertainty. Thoroughly researching the DeFi platform and understanding the associated risks is paramount before participating.

However, navigating the cryptocurrency landscape requires more than just knowledge of investment strategies. It demands a strong emphasis on security and risk management. Protecting your cryptocurrency holdings is crucial, given the prevalence of scams and cyberattacks. Using strong passwords, enabling two-factor authentication, and storing cryptocurrencies in cold storage (offline wallets) are essential security measures. Be wary of phishing scams and never share your private keys or seed phrases with anyone. It's also wise to diversify your cryptocurrency holdings across different exchanges and wallets to mitigate the risk of losing everything if one platform is compromised.

Beyond the technical aspects, remember the psychological dimension of investing. Emotions can cloud judgment and lead to impulsive decisions. It's crucial to develop a disciplined investment strategy and stick to it, even when the market is volatile. Avoid chasing quick profits and resist the temptation to sell during market downturns. Instead, focus on the long-term potential of your investments. Consider setting stop-loss orders to automatically sell your holdings if the price falls below a certain level, limiting your potential losses.

Before diving in, it is wise to first educate yourself. Many resources are available online, including reputable websites, courses, and communities. Start with the basics and gradually deepen your understanding of the technology, the market, and the risks involved. Don't be afraid to ask questions and seek advice from experienced investors, but always do your own research and make your own decisions.

Finally, remember the importance of managing expectations. Cryptocurrency investing is not a get-rich-quick scheme. It requires patience, discipline, and a willingness to learn and adapt. Start small, invest only what you can afford to lose, and gradually increase your investments as your knowledge and confidence grow. By following these guidelines, a stay-at-home mom can leverage the opportunities offered by cryptocurrency to supplement her income and achieve her financial goals, all while maintaining her commitment to her family. The keys are due diligence, risk management, and a long-term perspective.