Navigating the Cryptocurrency Conversion: USD to BTC with Keepbit

The cryptocurrency market, a dynamic and ever-evolving landscape, attracts investors and enthusiasts alike. Bitcoin (BTC), the pioneer and arguably the most well-known cryptocurrency, continues to hold significant value and influence. Converting between Bitcoin and fiat currencies like the US Dollar (USD) is a common activity, requiring reliable and accurate exchange platforms. When faced with the question "How much USD for 1.822 BTC?", finding a trustworthy source for the exchange rate becomes paramount. This article will delve into the factors influencing the USD/BTC conversion, assess the accuracy of Keepbit's platform, and provide guidance on navigating cryptocurrency exchanges.

Understanding the USD/BTC Exchange Rate

The price of Bitcoin, like any other asset, is determined by supply and demand. Numerous factors influence this dynamic, including:

- Market Sentiment: News, regulatory announcements, and general market trends can significantly impact investor confidence and, consequently, the price of Bitcoin. Positive news often leads to price increases, while negative news can trigger sell-offs.

- Global Economic Conditions: Macroeconomic factors, such as inflation, interest rates, and geopolitical events, can influence Bitcoin's perceived value as a store of value or an alternative investment.

- Regulatory Landscape: Government regulations surrounding cryptocurrency trading and usage vary widely across jurisdictions. Clarity and favorable regulations can boost Bitcoin's adoption and price, while restrictive regulations can have the opposite effect.

- Adoption Rate: As more individuals and businesses adopt Bitcoin for transactions or investment, its demand increases, potentially driving up its price.

- Technological Advancements: Developments in blockchain technology and the Bitcoin network, such as scalability improvements or security enhancements, can also influence its value.

The USD/BTC exchange rate fluctuates constantly, reflecting the interplay of these factors. It's crucial to consult multiple sources and consider the prevailing market conditions when determining the current value.

Assessing Keepbit's Accuracy and Reliability

Keepbit, like other cryptocurrency exchange platforms, aims to provide real-time USD/BTC exchange rates. However, the accuracy and reliability of these rates can vary. Here's a breakdown of factors to consider:

- Data Sources: Keepbit, and similar platforms, aggregate data from various cryptocurrency exchanges to calculate its exchange rates. The quality and reliability of these data sources are crucial. Ensure the platform sources its data from reputable and well-established exchanges.

- Fees and Commissions: While the displayed exchange rate might seem attractive, it's essential to factor in any fees or commissions charged by the platform. These fees can significantly impact the final amount of USD required for 1.822 BTC. Transparent and clearly disclosed fee structures are a sign of a trustworthy platform.

- Real-Time Updates: The cryptocurrency market is incredibly volatile, and exchange rates can change rapidly. A reliable platform should provide real-time or near real-time updates to its rates to reflect the current market conditions.

- Security Measures: Security is paramount when dealing with cryptocurrencies. Ensure Keepbit, or any other platform you use, employs robust security measures to protect your funds and personal information from hacking attempts and unauthorized access. Look for features like two-factor authentication (2FA), cold storage of funds, and regular security audits.

- User Reviews and Reputation: Research Keepbit's reputation by reading user reviews and checking its ratings on trusted review platforms. Pay attention to feedback regarding the accuracy of exchange rates, the speed of transactions, and the quality of customer support.

Beyond Keepbit: Exploring Alternative Platforms

While Keepbit may be a viable option, it's prudent to explore alternative cryptocurrency exchange platforms to compare rates and assess their reliability. Some popular and reputable platforms include:

- Coinbase: A widely used platform known for its user-friendly interface and security features.

- Binance: One of the largest cryptocurrency exchanges globally, offering a wide range of trading pairs and features.

- Kraken: A well-established platform with a focus on security and compliance.

- Gemini: A regulated exchange known for its institutional-grade security and compliance standards.

Comparing rates across multiple platforms can help you identify the most favorable exchange rate and ensure you're getting the best possible value for your USD when purchasing 1.822 BTC.

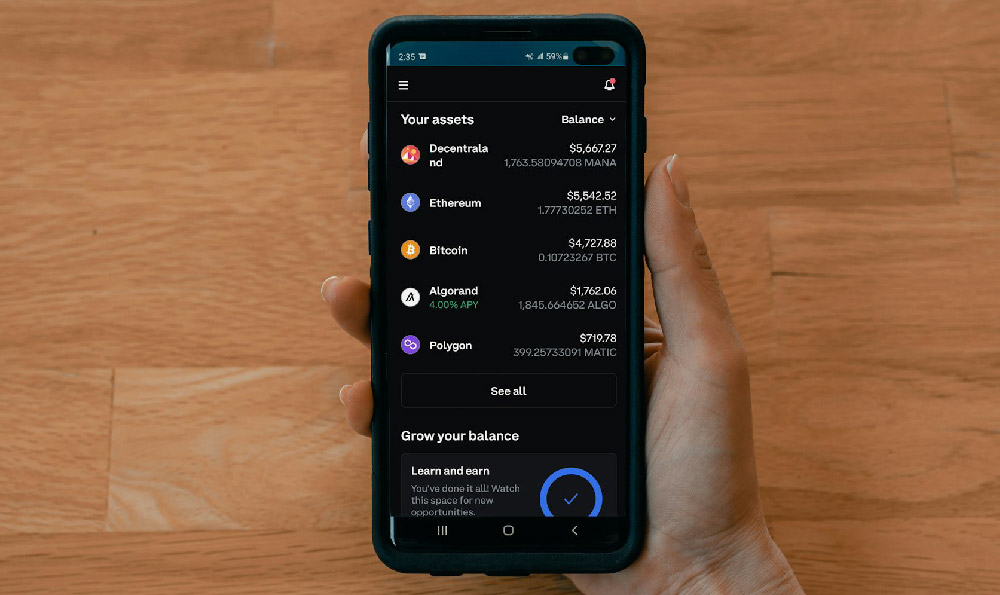

Calculating the USD Equivalent of 1.822 BTC

To determine the USD equivalent of 1.822 BTC, follow these steps:

- Find the Current USD/BTC Exchange Rate: Consult multiple reputable cryptocurrency exchange platforms or financial websites to find the current USD/BTC exchange rate.

- Multiply the Exchange Rate by the Amount of BTC: Multiply the USD/BTC exchange rate by 1.822 to calculate the approximate USD value.

For example, if the current USD/BTC exchange rate is $60,000 per Bitcoin, then 1.822 BTC would be worth approximately $109,320 (1.822 x $60,000 = $109,320).

Important Considerations Before Converting

Before proceeding with the conversion, consider the following:

- Market Volatility: The cryptocurrency market is highly volatile, and prices can fluctuate significantly in short periods. Be prepared for potential price changes and consider setting limit orders to mitigate risk.

- Transaction Fees: Factor in any transaction fees charged by the exchange platform or your bank. These fees can reduce the final amount of USD you receive or increase the cost of purchasing BTC.

- Tax Implications: Cryptocurrency transactions may be subject to taxes in your jurisdiction. Consult a tax professional to understand the tax implications of converting between USD and BTC.

- Security Best Practices: Always practice good security habits when dealing with cryptocurrencies. Use strong passwords, enable two-factor authentication, and store your private keys securely.

Conclusion: Informed Decision-Making in Cryptocurrency Exchange

Converting between USD and BTC requires careful consideration and informed decision-making. By understanding the factors influencing the USD/BTC exchange rate, assessing the accuracy of platforms like Keepbit, exploring alternative options, and considering the associated risks and fees, you can navigate the cryptocurrency market with greater confidence and make sound investment decisions. Remember to prioritize security and consult with financial and tax professionals as needed. The dynamic nature of cryptocurrency necessitates continuous learning and adaptation to stay informed and mitigate potential risks.