Launching an investment bank is an ambitious undertaking, demanding a potent blend of financial acumen, regulatory understanding, and entrepreneurial spirit. It’s not a venture for the faint of heart, requiring substantial capital, a robust network, and a well-defined strategy. The path is complex, interwoven with legal requirements, market dynamics, and the need to build trust and credibility. Let's dissect the key considerations and steps involved in initiating this challenging journey.

The foundational question is: What specific niche will your investment bank occupy? The investment banking world is vast and diversified. Are you targeting mergers and acquisitions (M&A) advisory, underwriting initial public offerings (IPOs), providing restructuring services, or specializing in a particular industry sector, like technology, healthcare, or renewable energy? Defining your niche is crucial. Specialization allows you to cultivate expertise, build a reputation, and attract clients who seek specific solutions. A boutique investment bank focusing on, say, renewable energy project finance will have a far clearer path to success than a generalist firm trying to be everything to everyone. This targeted approach will also inform your talent acquisition strategy, enabling you to hire individuals with relevant experience and industry connections.

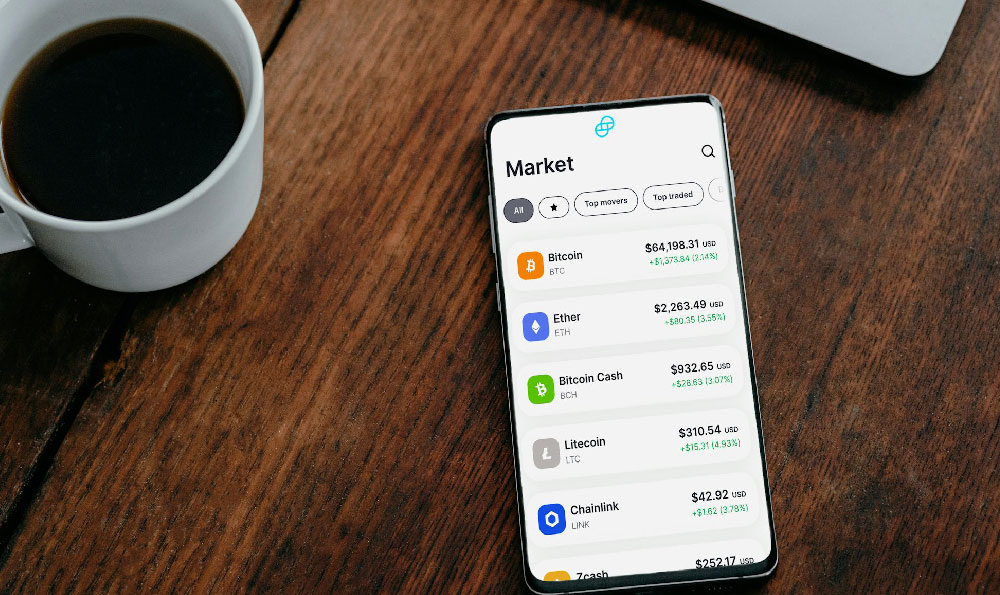

Next comes the critical matter of capitalization. Investment banking is a capital-intensive business. Regulatory requirements, operational expenses, and the need to underwrite deals all demand significant financial resources. The specific capital requirements will vary depending on the jurisdiction and the scope of your operations. Research the regulatory landscape in your chosen location and consult with legal and financial advisors to determine the necessary capital reserves. Beyond the initial capital injection, you’ll need to establish robust risk management protocols to protect against potential losses. This includes developing comprehensive due diligence procedures, implementing stringent compliance programs, and securing appropriate insurance coverage. Sources of capital can include private equity investments, venture capital funding, or even a strategic partnership with an existing financial institution. Each option comes with its own set of considerations regarding ownership, control, and financial obligations.

Choosing the right location is also paramount. Different jurisdictions offer varying regulatory environments, tax incentives, and access to talent and capital. Major financial centers like New York, London, and Hong Kong offer established infrastructure and a deep pool of experienced professionals, but they also present intense competition. Emerging markets, on the other hand, may offer greater growth potential but also come with increased regulatory complexities and political risks. Carefully evaluate the pros and cons of each location, considering factors such as market size, regulatory framework, availability of skilled labor, and the overall business climate. Establishing a presence in a jurisdiction that aligns with your niche and target market can significantly enhance your chances of success.

Building a strong team is non-negotiable. Investment banking is a people-driven business, and your team will be your most valuable asset. You need to assemble a group of experienced professionals with expertise in areas such as finance, law, accounting, and marketing. Look for individuals with a proven track record of success in their respective fields and a strong understanding of the investment banking industry. Crucially, integrity and ethical conduct are essential. The investment banking industry is built on trust, and any hint of impropriety can irreparably damage your reputation. Foster a culture of compliance and ethical behavior from the outset. Providing ongoing training and development opportunities will ensure that your team stays up-to-date on the latest industry trends and regulatory changes.

Regulatory compliance is a constant and evolving challenge. Investment banking is a heavily regulated industry, and compliance with all applicable laws and regulations is essential. Failure to comply can result in hefty fines, legal sanctions, and damage to your reputation. Develop a comprehensive compliance program that addresses all relevant regulatory requirements, including anti-money laundering (AML) laws, securities regulations, and data privacy laws. Engage with regulatory authorities proactively and seek guidance on complex compliance issues. Investing in robust compliance infrastructure, including technology and personnel, is crucial for mitigating regulatory risks. Continuous monitoring and auditing of your compliance program will ensure that it remains effective and up-to-date.

Marketing and business development are key to attracting clients and building a strong pipeline of deals. Develop a comprehensive marketing strategy that targets your chosen niche and highlights your expertise and capabilities. Utilize a variety of marketing channels, including online advertising, social media, industry conferences, and networking events. Build relationships with potential clients and referral sources. Emphasize your firm's unique value proposition and demonstrate your ability to deliver results. Networking and building relationships are paramount. Actively participate in industry events, join relevant associations, and cultivate relationships with potential clients, investors, and other industry professionals. A strong network can provide access to deal flow, capital, and valuable insights.

Finally, cultivate a culture of continuous improvement and innovation. The investment banking industry is constantly evolving, and you need to be adaptable and innovative to stay ahead of the curve. Embrace new technologies, explore new business models, and encourage your team to think creatively. Continuously monitor your performance, identify areas for improvement, and implement changes as needed. Staying abreast of industry trends and adapting your strategies accordingly is essential for long-term success.

Launching an investment bank is a marathon, not a sprint. It requires careful planning, meticulous execution, and unwavering commitment. By focusing on a specific niche, securing adequate capital, building a strong team, adhering to regulatory requirements, and cultivating a culture of innovation, you can increase your chances of success in this challenging but potentially rewarding industry. Remember that building trust and credibility takes time and consistent effort. Focus on delivering exceptional service to your clients and building a reputation for integrity and expertise.