Investing in the stock market can seem daunting, especially for beginners. The jargon, the volatility, and the sheer volume of information can feel overwhelming. However, with a clear understanding of the fundamentals and a well-defined strategy, anyone can participate in the stock market and potentially grow their wealth. This guide aims to demystify the process, providing a roadmap for beginners looking to enter the world of stock investing.

Before diving into the specifics, it's crucial to address the foundational element of any successful investment journey: financial planning. Assess your current financial situation. This involves understanding your income, expenses, debts, and assets. Create a budget to track your spending and identify areas where you can save more money for investing. Determine your financial goals. Are you saving for retirement, a down payment on a house, or simply building wealth? Your goals will influence your investment timeline and risk tolerance. Finally, understand your risk tolerance. Are you comfortable with the possibility of losing some of your investment in exchange for potentially higher returns? Or do you prefer a more conservative approach with lower risk but also lower potential rewards? Answering these questions honestly is paramount, as they will guide your investment decisions.

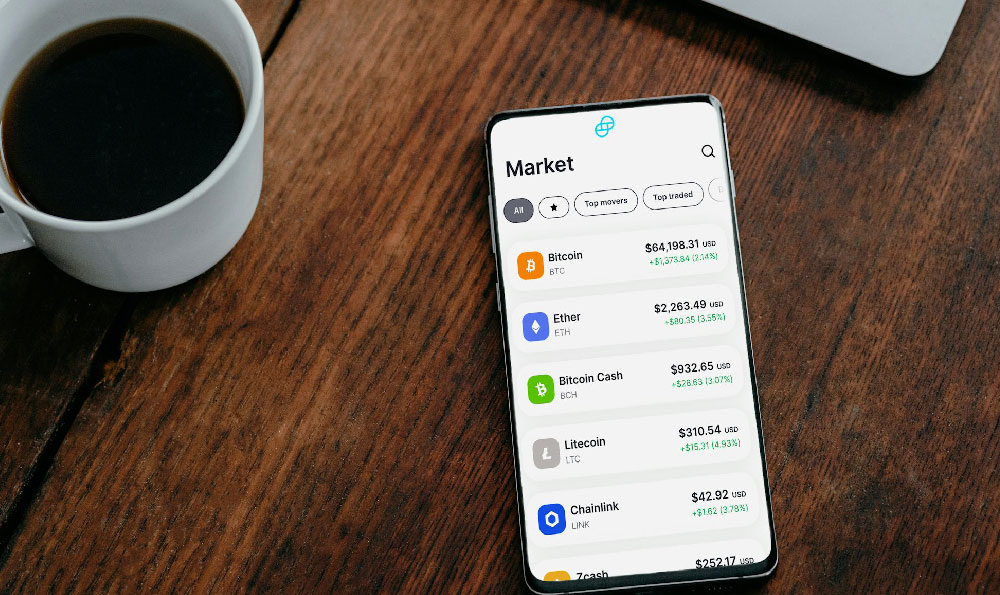

Once you have a solid grasp of your financial situation, the next step is to choose a brokerage account. A brokerage account is an account you open with a financial institution that allows you to buy and sell stocks, bonds, and other investments. There are numerous brokerage firms to choose from, each offering different features, fees, and services. Consider factors like commission fees (some brokers offer commission-free trading), account minimums, investment options, research tools, and the quality of customer service. Popular choices include Charles Schwab, Fidelity, Vanguard, and Interactive Brokers. Research different options, compare their offerings, and choose a brokerage that aligns with your needs and preferences. Make sure the brokerage is reputable and regulated by a recognized financial authority like the SEC in the US.

Now comes the exciting part: learning about stocks and the stock market. A stock represents ownership in a company. When you buy a share of stock, you become a part-owner of that company and are entitled to a portion of its profits, usually distributed as dividends (although not all companies pay dividends). The price of a stock is determined by supply and demand in the stock market, which is essentially a marketplace where buyers and sellers come together to trade stocks. Numerous factors can influence stock prices, including company performance, economic conditions, industry trends, and investor sentiment. Understanding these factors is crucial for making informed investment decisions.

There are different types of stocks. Common stock gives shareholders voting rights in the company and a claim on its assets after bondholders and preferred stockholders. Preferred stock typically does not come with voting rights but pays a fixed dividend, making it a less volatile option. Large-cap stocks are stocks of companies with a large market capitalization (total value of outstanding shares), typically considered more stable and less risky than small-cap stocks, which are stocks of companies with a smaller market capitalization and potentially higher growth potential but also higher risk.

Before investing in any stock, it is imperative to conduct thorough research. This involves analyzing the company's financial statements, understanding its business model, and evaluating its competitive position within its industry. Key financial metrics to consider include revenue growth, profitability (e.g., net income, earnings per share), debt levels, and cash flow. Look at the company's balance sheet, income statement, and cash flow statement. Read analyst reports and news articles to get a broader perspective on the company's prospects. Also, consider the broader economic context. Is the industry the company operates in expected to grow or decline? Are there any regulatory changes that could affect the company?

Once you have conducted your research and identified potential investment opportunities, it's time to develop an investment strategy. A fundamental strategy involves analyzing a company's intrinsic value (what the stock is truly worth) based on its financial performance and future prospects. Value investors look for undervalued stocks – stocks that are trading below their intrinsic value – with the expectation that the market will eventually recognize their true worth. Growth investors, on the other hand, focus on companies with high growth potential, even if their current valuation is high. A technical strategy involves analyzing stock price charts and using technical indicators to identify trends and patterns that can predict future price movements. Technical analysts use tools like moving averages, trendlines, and volume indicators to make trading decisions.

Diversification is a critical element of any sound investment strategy. It involves spreading your investments across different asset classes, industries, and geographic regions to reduce risk. Avoid putting all your eggs in one basket. By diversifying, you can minimize the impact of any single investment performing poorly. Index funds and Exchange-Traded Funds (ETFs) are excellent vehicles for diversification. Index funds track a specific market index, such as the S&P 500, providing broad market exposure. ETFs are similar to index funds but trade like stocks on an exchange, offering greater flexibility.

Investing in the stock market is a long-term game, not a get-rich-quick scheme. Avoid the temptation to chase short-term gains or try to time the market. Instead, focus on building a diversified portfolio of quality investments and holding them for the long term. Warren Buffett, one of the most successful investors of all time, famously said, "Our favorite holding period is forever." The concept of dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the stock price. This strategy helps to smooth out the impact of market volatility and can lead to better returns over time.

Finally, remember that the stock market can be volatile. There will be periods of market downturns and corrections. It's important to stay calm during these times and avoid making emotional decisions. Don't panic sell your investments when the market drops. Instead, use market downturns as opportunities to buy more shares of quality companies at discounted prices. Continually educate yourself about the stock market and the companies you invest in. Read books, articles, and blogs about investing. Attend seminars and webinars. The more you know, the better equipped you will be to make informed investment decisions. Review your portfolio regularly and make adjustments as needed. Your investment needs and goals may change over time, so it's important to adapt your strategy accordingly.