The VIX index, often referred to as the “fear gauge,” is a real-time market index representing the market’s expectation of 30-day volatility. It is derived from the price of S&P 500 index options, and its movements often have an inverse relationship with the stock market. While you can't directly invest in the VIX itself, you can gain exposure through various financial instruments. Understanding how, when, and why to consider VIX-related investments requires careful consideration and a grasp of its inherent complexities.

Several avenues exist for investors seeking to capitalize on VIX movements. The most common are Exchange Traded Funds (ETFs) and Exchange Traded Notes (ETNs) designed to track VIX futures. It's crucial to recognize that these instruments don't track the spot VIX directly, but rather a basket of VIX futures contracts with varying expiration dates. This introduces a phenomenon called "contango" and "backwardation," which significantly impacts returns.

Contango occurs when VIX futures prices are higher than the spot VIX price. This is the more common scenario. When an ETF or ETN holds VIX futures in contango, it needs to "roll" those futures contracts forward as they approach expiration. This involves selling the expiring contracts and buying contracts with a later expiration date, which are at a higher price. This constant buying high and selling low erodes the value of the investment over time. This is particularly detrimental during periods of low volatility, as the roll costs become more pronounced.

Backwardation, on the other hand, is when VIX futures prices are lower than the spot VIX price. In this case, rolling futures contracts generates a positive return, as the expiring contracts are sold at a higher price than the later-dated contracts being purchased. Backwardation typically occurs during periods of high market stress and heightened volatility.

Given the impact of contango, VIX-related ETFs and ETNs are generally not suitable for long-term buy-and-hold strategies. Their performance is often underwhelming or even negative over extended periods, even if the spot VIX experiences periodic spikes. These instruments are better suited for short-term, tactical trades aimed at profiting from anticipated volatility surges.

Timing is paramount when considering VIX investments. Identifying potential catalysts for increased market volatility is crucial. These catalysts can include geopolitical events, unexpected economic data releases, Federal Reserve policy announcements, earnings season, or even a sudden market correction. Monitoring macroeconomic indicators, news headlines, and technical analysis of market trends can help identify periods of increased risk and potential opportunities for VIX-related investments.

When a catalyst is identified, and a volatility spike is anticipated, investors can consider purchasing VIX ETFs or ETNs. However, it's essential to be nimble and have a clear exit strategy. Holding these instruments for extended periods, particularly during periods of low volatility, can lead to significant losses due to the contango effect.

Another approach is to use options on VIX futures. This allows for more precise control over the level of exposure and potential risk. Buying call options on VIX futures can provide leveraged exposure to upward movements in volatility, while limiting potential losses to the premium paid for the option. However, options trading requires a higher level of understanding and experience.

Risk management is absolutely critical when dealing with VIX-related investments. Volatility is inherently unpredictable, and VIX instruments can be extremely volatile themselves. Setting stop-loss orders is essential to limit potential losses if the market moves against your position. It's also important to avoid over-leveraging your position, as this can amplify both potential gains and losses.

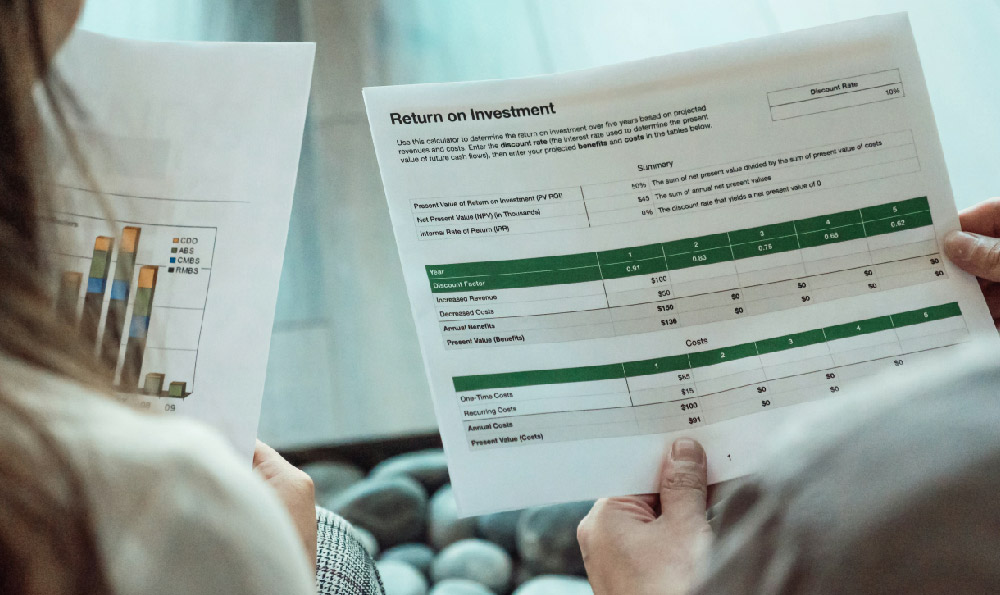

Before investing in VIX instruments, it's imperative to conduct thorough due diligence. Read the prospectus of the ETF or ETN carefully to understand its investment strategy, potential risks, and historical performance. Pay close attention to the expense ratio, which can significantly impact returns over time. Consider the trading volume of the instrument to ensure sufficient liquidity for entering and exiting positions.

Diversification is a fundamental principle of sound investment management. VIX-related investments should not constitute a significant portion of a well-diversified portfolio. They are best used as a tactical tool to hedge against potential market downturns or to profit from short-term volatility spikes.

Finally, remember that the VIX is a complex index with its own unique characteristics. It is not a magic bullet for generating guaranteed profits. Investing in VIX-related instruments requires a deep understanding of market dynamics, volatility, and the nuances of futures trading. If you are not comfortable with these complexities, it is best to seek the advice of a qualified financial advisor. A thorough understanding of your own risk tolerance and investment goals is essential before making any investment decisions. The VIX can be a valuable tool in the hands of a knowledgeable and disciplined investor, but it can also be a source of significant losses for those who are unprepared.